Falling behind on your payments and having your debt accumulate can be a nerve-wracking experience. If you have outstanding debts beyond your ability to pay them, filing for bankruptcy may be a suitable solution for your situation. A seasoned Orlando bankruptcy attorney can help you explore your legal options.

In 2021, 5,907 bankruptcy cases were filed in the Orlando Division. This is because this legal procedure allows people to get their finances in order. Since it can be a time-consuming and complex process, you should seek the advice of a bankruptcy lawyer near you.

At Z. Hernandez Law, we help Floridians file their bankruptcy cases and work to make this process as smooth as possible for you. If you have large debts and are looking for a bankruptcy lawyer near Orlando or Ocala, we may be able to help. Contact us today to schedule an appointment with our team.

What Is Bankruptcy?

Bankruptcy is a legal process meant to give the honest debtor a fresh start from burdensome debt. In other words, filing for bankruptcy in Orlando allows debtors to reduce or eliminate certain types of debts.

Filing for bankruptcy allows you to restructure your debts into a repayment plan with lower and affordable payments, or if you meet certain income requirements, have your unsecured debts completely discharged.

Getting a discharge is the primary goal of a bankruptcy case. If the Court grants you a discharge, you are no longer required to pay your remaining debts. However, according to section 523 of The Bankruptcy Code, certain debts cannot be discharged.

Some common examples of debts that you cannot discharge when filing bankruptcy in Florida are:

- Certain tax debts

- Alimony and child support

- Debts for fines and penalties

- Personal injury claims caused by a DUI

- Most student loans

- Debts for willful and malicious injuries to a person or property

In addition to having most of your debts discharged, the automatic stay provision will become effective immediately upon filing for bankruptcy in Orlando. This protection prevents creditors from taking any debt collection actions against you during the length of your bankruptcy case.

There is no doubt that bankruptcy provides many benefits to debtors. However, it is also a complex process with diverse rules, laws, forms, and exemptions that you need to take into account. To hire the best bankruptcy attorney for your case in Orlando, FL, you must ensure that he or she:

- Is experienced in bankruptcy law.

- Is familiar with the local rules for the Middle District of Florida.

- Has helped people with debts similar to yours.

Z. Hernandez Law can help you explore your legal options. Call (407) 900-8490 to book an appointment.

Advantages of filing bankruptcy in Orlando, FL

Oftentimes, bankruptcy is perceived negatively. But despite this negative perception, bankruptcy offers many benefits to debtors. Some of these benefits include, but are not limited to:

- Stopping creditor harassment.

- Helping you organize your debts into manageable payments.

- Relieving you from the obligation of paying credit card debt, medical bills, and other unsecured debts.

- Ability to keep some of your property through Florida exemptions.

- Stopping foreclosure, repossession, and debt collection actions.

- Providing the honest debtor with a fresh financial start.

Many people looking to file bankruptcy in Orlando are concerned about the potential consequences of this process. If you want to explore if bankruptcy is the most suitable path to handle large debts, book a consultation with an Orlando bankruptcy lawyer.

Types of Bankruptcies ZHL Lawyers Can Handle in Greater Orlando

Title 11 of the U.S. Code, also known as the Bankruptcy Code, provides six basic types of bankruptcy. Z. Hernandez Law specializes in consumer debt. In other words, we help individuals that incurred debt for personal, household, or family reasons.

At Z. Hernandez Law, we have extensive experience filing:

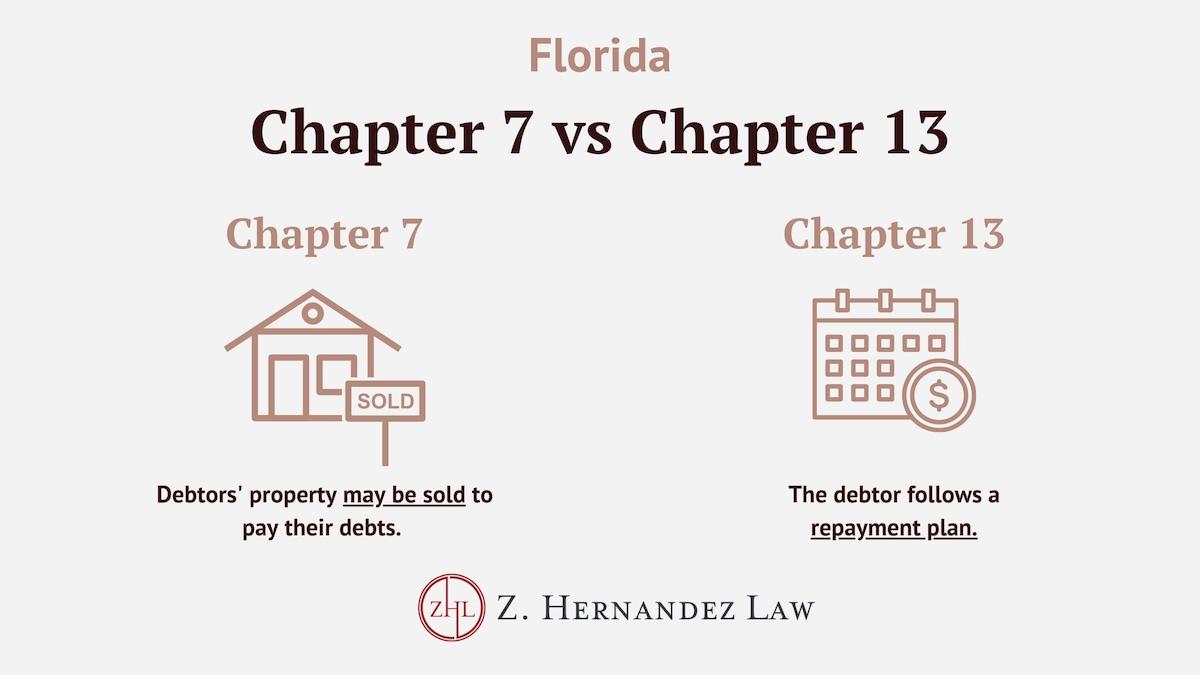

- Chapter 13 bankruptcy. This type of bankruptcy is suitable for debtors with regular income. Filing for Chapter 13 bankruptcy allows people to repay their debts over an extended period (3-5 years). Under this chapter, debtors can prioritize their debts and create a repayment plan based on what they can afford to pay. To receive a discharge, you must complete the payments laid out in your plan.

- Chapter 7 bankruptcy. Also known as liquidation bankruptcy, this chapter distinguishes itself by allowing trustees to sell nonexempt property and use the proceeds to pay creditors. Once completed, debtors receive their discharge. Filing Chapter 7 in Orlando does not necessarily mean that you would lose your property. A bankruptcy attorney can help you determine what Florida exemptions you should use to protect your assets.

When it comes to filing bankruptcy, choosing the appropriate chapter for your situation is crucial. If you are not familiar with the law, you may compromise your chances of success. As a result, you should seek the help of a bankruptcy lawyer near you.

Bankruptcy Attorneys Serving the Following Areas

The Middle District of Florida has four Bankruptcy Divisions. At Z. Hernandez Law, our law firm represents clients filing in the Orlando Division. If you are located nearby one of these cities or counties, we may be able to help you with your case:

- Orlando

- Maitland

- Ocala

- Seminole County

- Lockhart

- Ocoee

- Clemont

- Altamonte Springs

- Apopka

- Casselberry

- Longwood

- Sanford

- Winter Garden

- Cocoa

- Kissimmee

- St. Cloud

- Lake Mary

- Oviedo

- Deltona

- Orange City

- Osceola County

What Happens When You File for Florida Bankruptcy

Bankruptcy can be overwhelming for many Floridians because they do not know what to expect when starting this process. For starters, it is important that your case abides by the Middle District Local Rules.

Here is a quick overview of the process and what to expect when filing for bankruptcy:

- Taking a credit counseling course: One of the requirements to file for bankruptcy in Florida is to take credit counseling with an authorized provider.

- Filing your forms and petition: To file bankruptcy, you must complete certain forms where you provide information about your income, debts, property, etc. When filing your forms, you are also required to pay some filing fees.

- Debt collection actions are stopped: Once your case has been filed, the Bankruptcy Court will grant you an injunction to prevent creditors from taking any collection action against you.

- Attending a 341 meeting: After filing, you are required to attend a meeting of creditors (or 341 meeting). The purpose of this meeting is for creditors to ask you questions about your debts and property.

- Handling your debt: The type of bankruptcy you filed determines the way your debt will be handled. If you filed Chapter 7 and your property is exempt from bankruptcy, most of your debts will be discharged quickly. However, if you filed Chapter 13, you must make payments until you complete your repayment plan.

- Taking debtor education: Regardless of the type of bankruptcy you filed, you are required to complete a debtor education course before receiving your discharge. Failing to complete this course can result in the dismantling of your case.

- Receiving a fresh financial start: The goal of bankruptcy is to relieve debtors from the burden of certain debts. Therefore, when you complete your case, you are not required to pay most of your debts.

Speak to a Bankruptcy Attorney in Orlando – Contact Z. Hernandez Law

31,541 bankruptcy cases were filed in Florida in 2021. Although this process is very common, we understand that dealing with the weight of your debts and the complexity of the law can be stressful. An experienced bankruptcy attorney in Orlando can help you pilot through this complicated process.

Z. Hernandez Law is a law firm that specializes in Chapter 7 and Chapter 13 bankruptcy. We represent people filing for bankruptcy in Orlando, Maitland, Ocala, Ocoee, Kissimmee, and nearby areas.

If you are overwhelmed with debt, call (407) 900-8490 or book a consultation through our contact form to explore your legal options.