79% of bankruptcy cases filed in the Middle District of Florida were Chapter 7. This is because this type of bankruptcy provides Floridians with a quick financial fresh start. However, before filing this chapter, you should seek the help of a Chapter 7 bankruptcy attorney in Orlando to assess your options.

Chapter 7 is a debt relief option for people who are unable to repay their debts. Although this type of bankruptcy can help you discharge most of your outstanding bills, there are certain eligibility criteria that you must meet.

If you are considering filing for bankruptcy in the Orlando Division, it may be in your best interest to consult a Chapter 7 lawyer near you. An Orlando bankruptcy attorney at Z. Hernandez Law can help you explore the best bankruptcy options available to you. Contact us to schedule an appointment.

What Is Chapter 7 in Florida?

Chapter 7 is known as a liquidating bankruptcy. In other words, trustees have the authority to sell the debtor’s nonexempt property and use the proceeds to pay some of their debts. Unless debts are ineligible, the remaining balance will be discharged after the bankruptcy filing is completed.

Unlike a Chapter 13 bankruptcy, filing Chapter 7 in Florida does not require debtors to make monthly installments to repay their debts. On the contrary, Chapter 7 bankruptcy consists of selling some of your eligible assets to repay your creditors.

Although it is known as liquidating bankruptcy, filing Chapter 7 does not mean that you would lose all of your property. The purpose of the Bankruptcy Code is to provide debtors with a fresh start, which would hardly happen if you lose all of your assets to your creditors.

To help you protect your property, debtors filing Chapter 7 can use Florida bankruptcy exemptions. Most Chapter 7 bankruptcies result in non-asset cases. This simply means that the bankruptcy exemptions help protect all of the property from being sold. Despite this, most of your debts will still be discharged.

Chapter 7 is a powerful debt relief option for people with outstanding unsecured debts, such as medical bills, personal loans, and credit card debt. However, the following debts cannot be discharged under this Chapter:

- Debts for alimony or child support

- Certain taxes

- Debt for personal injury or death caused by a DUI

- Certain criminal restitution orders

- Debts for willful or malicious injury to an individual, property, or other entity

- Student loans

How does Chapter 7 handle secured debt?

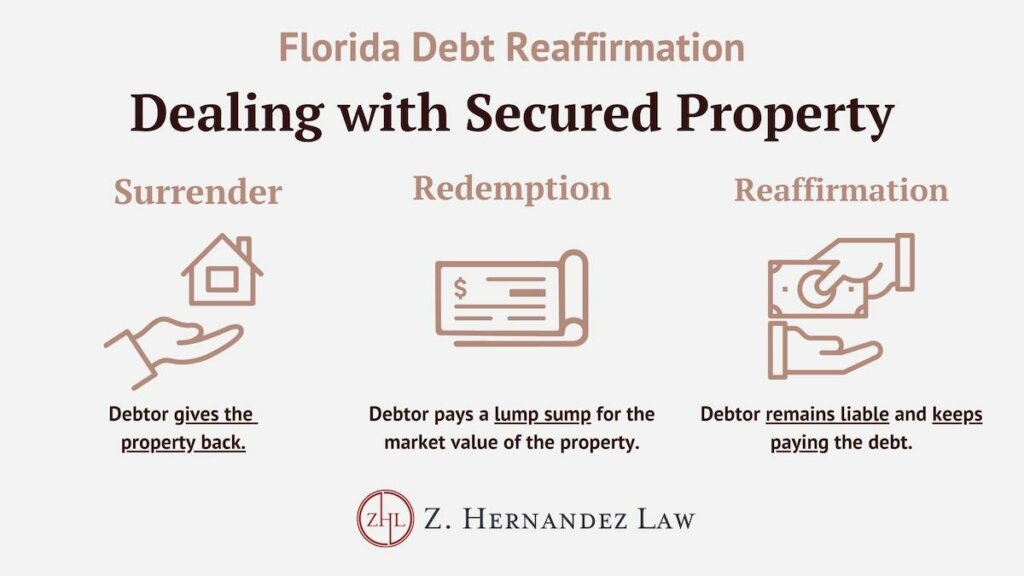

Florida exemptions help you deal with your secured debts (with collateral). With this type of debt, there are three options:

- Surrender the property: you give back the property to the creditors because you do not wish to keep paying this debt.

- Reaffirm the debt: you agree to pay the debt associated with the collateral, which means that this debt will not be discharged by bankruptcy. As long as you make the required payments, you can keep your property. However, if the Bankruptcy Court considers that this debt is significantly difficult to handle, they may rescind your agreement.

- Redeem: a secured debt can also be redeemed if the debtor pays a lump sum for the market value of the property.

Dealing with secured creditors is one of the most complicated subjects when filing Chapter 7 in Florida. At Z. Hernandez law, we are committed to protecting your personal assets while getting you the financial start you deserve.

Book an appointment with our Chapter 7 bankruptcy attorney. We represent clients filing bankruptcy in Orlando, Ocoee, Maitland, Kissimmee, Clermont, Daytona, and surrounding areas.

Requirements to file chapter 7 bankruptcy in Orlando

To be eligible to file Chapter 7 bankruptcy in the Orlando Division, debtors must meet the following requirements:

- Be an individual, corporation, partnership, or other business entity.

- Take a credit counseling course within 180 days before filing.

- Not having a prior bankruptcy case dismissed within 180 days before filing.

- Not having received a previous discharge in the last 8 years under another Chapter 7 or in the last 6 years under Chapter 13 bankruptcy.

- Pass the means test if your monthly income is greater than Florida’s median income ($55,681 for an individual and $89,206 for a family of four, as for 2022).

Unlike Chapter 13 bankruptcy, you can file Chapter 7 in Florida regardless of the amount of debt you owe, as long as you meet the requirements above. It is important to note that if the Bankruptcy Court considers that you have enough disposable income to repay a portion of your debt, your Chapter 7 case may be converted to Chapter 13.

Facts & Statistics about Chapter 7 Bankruptcy

- According to the Florida Bankruptcy Filing Trends Report compiled by The American Bankruptcy Institute:

- There were 31,541 bankruptcies filed in the state of Florida in 2021. Nearly 71.9% of those were Chapter 7.

- In other words, more than 104 out of every 100,000 Floridians filed for Chapter 7 bankruptcy in 2021.

- In 2021, Florida’s median household and per capita income levels are 11.5% and 7.2% lower than their respective national median income counterparts.

- Between January and August, 2022, there were 6,882 and 3,387 Chapter 7 cases filed in the Middle and South Districts of Florida, respectively. The two districts represent over 90% of all bankruptcies filed in the state.

Chapter 7 & Florida Exemptions

When filing for bankruptcy, debtors can claim Florida exemptions to prevent their property from being sold. Exemptions are state laws that protect property up to a certain value from bankruptcy procedures.

Florida bankruptcy exemptions are commonly related to Chapter 7 since it relies on selling property to repay debts. Some of the property for which you can claim exemptions in Florida includes, but is not limited to:

- Motor vehicles

- Homestead

- Retirement accounts

- Disability income

- Qualified hurricane savings

- Qualified tuition programs and medical savings

- Personal property (wildcard exemption)

Here is a very simplified example of how exemptions work.

John files Chapter 7 in the Orlando Division. At the moment of filing, he owes:

- $55,000 in credit card debt

- $9,700 in medical bills

- $2,500 on a car loan

As unsecured debts, his medical bills and credit card debts are discharged. John claims the $1,000 motor vehicle Florida exemption. With this in place, John’s car debt comes down to $1,500. At this point, he can reaffirm this debt and agree to pay the $1,500 to keep his car.

Florida exemptions can be complicated if you are unfamiliar with the way they work. Before you file your bankruptcy case, you should consult with a Chapter 7 lawyer serving Orlando to ensure that your property is well-protected.

Filing Chapter 7 in Orlando without an Attorney

When facing outstanding debts, many people think that hiring a lawyer would add stress to their financial situation. However, due to the complexity of the process, having the help of an Orlando bankruptcy lawyer can increase your chances of a successful outcome.

If you are looking to file Chapter 7 without an attorney, known as filing pro se, some of the things you may need to do include, but are not necessarily limited to:

- File in person

- Complete credit counseling

- File the corresponding forms

- Completing your statement of intention

- Claiming exemptions

- Listing your property

- Listing your expenses and income

- Adding codebtors if applicable

- Listing your secured and unsecured debts

- Completing your statement of financial affairs

- Completing the means test

- Amend schedules if applicable

- File motions if applicable

- Complete the debtor education course

Even though it can help you discharge most of your debts, Chapter 7 is a complicated process with many rules and regulations to keep in mind. Making a mistake on your form can result in the loss of your property and making a false statement can lead to severe penalties and repercussions.

You owe it to yourself to seek the legal representation you deserve.

Book a Consultation with a Chapter 7 Attorney in Orlando

Dealing with the weight of your financial obligations can be frustrating and stressful, especially if you are not sure what the next steps are. Filing Chapter 7 can provide you with quick debt relief. An experienced Chapter 7 lawyer assisting clients in Orlando can help you assess your situation.

At Z. Hernandez Law, we are not looking to add more stress to your financial situation with expensive legal fees. Our bankruptcy attorneys understand what you are going through and are committed to providing you with customized legal representation.

If you are looking to file bankruptcy in Orlando, Ocoee, Maitland, Ocala, Daytona, Kissimmee, and surrounding areas, call us today at (407) 900-8490 or book a consultation online now.